- Our Basic Concept

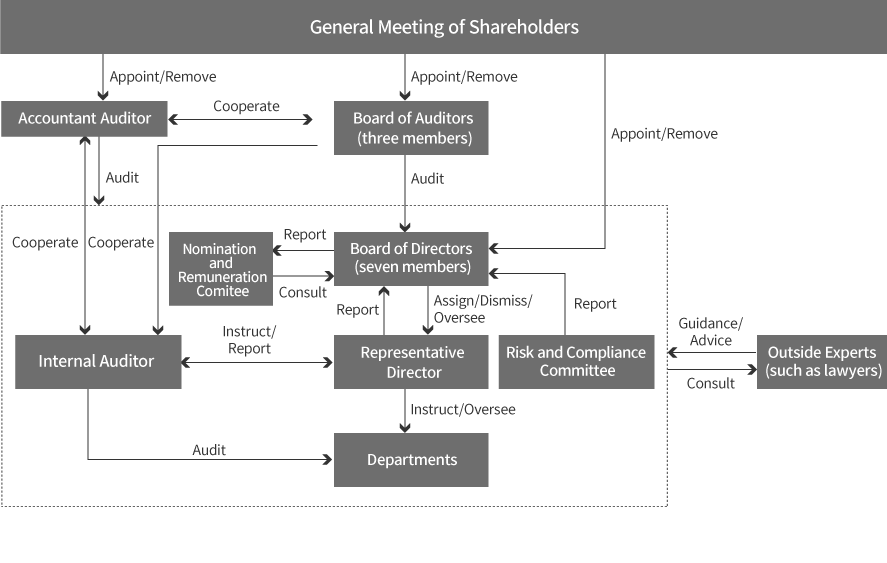

- Corporate Governance System

- Efficiency Evaluation

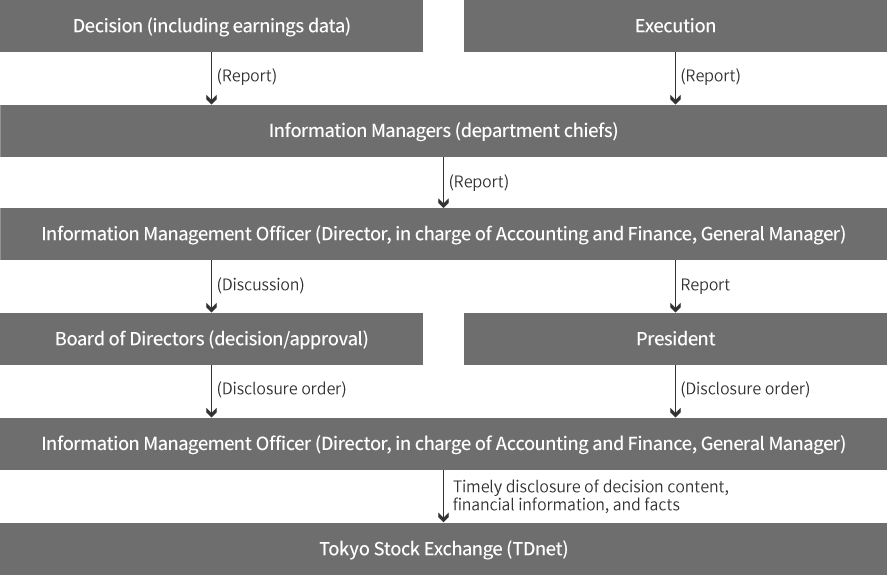

- Timely Disclosure

- Internal Control System

- Audit System

- Officer Compensation

Our Basic Concept

NEOJAPAN’s corporate philosophy is to “contribute to the formation of an abundant society through real IT communications.” Our goal is to provide not only a few advanced companies with the advantages of top-end IT, but all companies.

Based on this corporate philosophy, we see building corporate governance as essential to improving corporate value so as to fulfill the expectations and trust of our stakeholders—including NEOJAPAN’s shareholders, business partners and employees—and we endeavor to construct the optimal administrative structure to ensure sound, efficient and transparent operations.

Corporate Governance System

NEOJAPAN has adopted a corporate auditor system. In accordance with the Companies Act of Japan, the company convenes general meetings of shareholders and has set up a Board of Directors and Board of Auditors.

The seven members of the Board of Directors (of whom three are outside director) engage in prompt decision-making and NEOJAPAN ensures that the Board plays an active role. Furthermore, The three members of the Board of Audit & Supervisory Board (of whom two are outside director) . This arrangement maintains fair and transparent management based on objective, neutral auditing of the company’s business affairs. We believe these two bodies create corporate governance with an efficient managerial system and fully functioning business auditing.

Board of Directors

| Number of members | 7 (including 3 outside directors) The Articles of Incorporation stipulate a maximum of 8 directors of the Company |

|---|---|

| Duties | Determine on important management matters, such as management policies, and legal matters; oversee the execution of business. |

| Meeting schedule | Monthly, in principle Meetings held as needed to accelerate management decisions |

Audit & Supervisory Board

| Number of members | 3 (including 2 outside auditors) One member is a full-time auditor |

|---|---|

| Duties | Confirm and discuss the status of audits, collaborate with the Internal Audit Office and accounting auditors, and periodically request reports on audits. Attend meetings of the Board of Directors, conduct business audits and accounting audits including interviewing directors and reviewing materials. Full-time Audit & Supervisory Board Members attend meetings of the Board of Directors and other important meetings, and fully audit the business execution of directors. |

| Meeting schedule | Held once a month, in principle |

Nomination and Remuneration Committee

| Number of members | 3 (President and 2 outside directors) the majority of the members, including the chairperson, are independent outside directors. |

|---|---|

| Duties | Aiming to strengthen the supervisory function of the Board of Directors and enhance the corporate governance system by increasing the transparency and objectivity of procedures related to the nomination and remuneration of directors, the Nomination and Remuneration Committee has been established as an advisory body to the Board of Directors.The Committee is chaired by outside director Shigehiko Matsumoto. |

Efficiency Evaluation

Aiming to always increase the effectiveness of our board of directors, as well as the value of our business itself, we regularly evaluate the efficiency of our board of directors, and release a summary of the results

Timely Disclosure

At our company, the Administration Department is in charge of the presentation of timely disclosure and the person responsible is the executive director of the Administration Department.

The Company endeavors to provide fair, timely, and appropriate corporate information disclosure in compliance with the “Financial Instruments and Exchange Law,” the “Tokyo Stock Exchange Regulations,” the “Rules for Timely Disclosure of Company Information of Issuers of Listed Securities,” and all relevant laws and regulations. The person in charge examines the information, follows set procedures, and in a timely manner announces information that should be disclosed.

Internal Control System

The Board of Directors has established the “Basic Policy for Internal Control System Construction” and has formulated a framework for ensuring the effectiveness and appropriateness of business operations. The internal control system has a structure for ensuring directors and employee activities comply with the Articles of Incorporation, laws and regulations, and rules associated with the management of risk of loss.

We continually seek to improve and strengthen the internal control system by reviewing regulations regarding policy content and conducting regular internal audits to verify the functional effectiveness of the internal controls.

Audit System

Internal Audits and Auditor Audits

The Company has established an Internal Auditing Office, which reports directly to the representative director. Four auditors with concurrent positions in business departments conduct internal audits. The Internal Auditing Office audit the appropriateness and effectiveness of the business execution of the business departments in accordance with internal audit guidelines and the plan for the fiscal year, and of the overall Company’s business operations in accordance with internal rules, management policies, and laws and regulations. The auditors report the audit results to the board of directors the representative director and auditor and advise departments of proposals to improve operations.

Regarding audits by Audit & Supervisory Board Members, in addition to conducting audits based on the content set in the Audit & Supervisory Board Audit Plan, auditors attend meetings of the Board of Directors and others, advise on ways to strengthen the management oversight function, review documents related to important company decisions, and audit the appropriateness of the execution of duties and decision-making by the Board of Directors.

Corporate auditors have a system to regularly hold discussions and exchange opinions with The Internal Auditing Office and accounting auditors.

Accounting Audits

The Company has an audit contract with Azusa Audit Corporation, a limited liability company. No special interest exists between the Company and the auditing corporation or the Company and the executive officers of the auditing corporation that audit the Company. The certified public accountants that conducted the audits of the corporate accounts were Yasuyuki Morimoto and Shohei Takiura, a certified public accountant.

Four certified public accountants four persons who have passed the accountant examination and five others from the Company assist in the audits.

Outside Directors and Auditors

Our company appoints three outside directrs and two outside corporate auditors. Enhancing and strengthening corporate governance is a priority. The Company continuously seeks to strengthen the management oversight function and maintains a governance framework incorporating the neutral perspectives of outside directors and auditors in corporate supervision and audit activities with the aim of enhancing business soundness and transparency. Outside directors and auditor with an abundance of experience, knowledge, and specialized expertise from various industries attend meetings of the Board of Directors, participate in decision-making related to business execution, provide oversight, and conduct audits.

The Company has established criteria for determining the independence of outside officers based on Tokyo Stock Exchange guidelines concering the independence of independent officers.

Outside director Hirofumi Ozaki has abundant experience and deep insight as a tax accountant for numerous corporate clients. Shigehiko Matsumoto has abundant experience and deep insight as a manager of various corporate operations at financial institutions and companies, including in the system development field. Toshio Iwasaki have many years of experience in financial institutions, deep insight and experience as managers.

Outside auditor Masahiko Umezono have many years of experience in financial institutions, extensive experience as a full-time auditor of the company and other companies and extensive knowledge of finance and accounting. Yuriko Kanematsu was deemed suitable as an outside auditor based on his abundant experience and expertise in legal affairs as a lawyer.

The Company has transactions with Surugadai Certified Public Tax Accountants' Corporation, of which Hiroshi Ozaki is the representative, for cloud services, the amount of such transactions is minimal and is not considered to affect the independence of the outside directors. No personal, capital, or other conflicts of interest exist between the Company and Hiroshi Ozaki.

There are no personal, capital, business, or other material interests between the Company and the outside directors and outside corporate auditors other than Hiroshi Ozaki.

Officer Compensation

| Officer classification | Total compensation (yen in thousands) |

Total remuneration by type (yen in thousands) |

Number of officers (persons) |

||

|---|---|---|---|---|---|

| Fixed Compensation |

Performance-based Compensation | Of the items on the left: Non-monetary remuneration, etc. | |||

| Directors (excluding outside directors) | 154,317 | 152,988 | - | 1,329 | 4 |

| Auditors (excluding outside auditors) | 6,030 | 6,030 | - | - | 1 |

| Outside officer | 18,420 | 18,420 | - | - | 6 |

- * Total remuneration for each officer of the submitting company is not presented because no individual total remuneration exceeds ¥100 million.